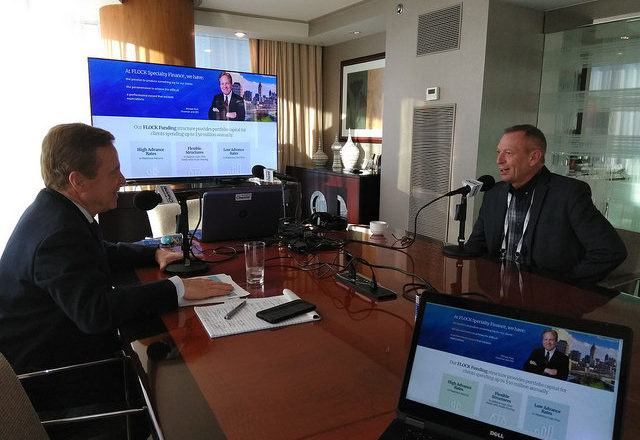

➡ ➡ David Ludwig Founder of National Loan Exchange NLEX, and a Godfather of the Debt Buying Industry on Capital Club Radio

Michael Flock interviews David Ludwig, Founder of NLEX, a company formed to promote and broker the sale of distressed assets. In their conversation, Dave shares how he developed his business, managed it through tough economic times and is now building the NLEX of the future.

Dave has taken NLEX from its start, as a post-RTC sales outlet in the 1980’s, to today, where it is the nation’s leading broker of charged-off credit card and consumer debt accounts. NLEX’s parent company conducted the industry’s first public sale of charge-offs for Bank of America in 1989. With that experience, Dave introduced selling charge-offs from financial institutions by hosting the industry’s first debt sale conference in 1994. Since then, Dave and his team have supervised sales of over 5,000 portfolios with face value of $150 billion in the US and Canada.

Dave has taken NLEX from its start, as a post-RTC sales outlet in the 1980’s, to today, where it is the nation’s leading broker of charged-off credit card and consumer debt accounts. NLEX’s parent company conducted the industry’s first public sale of charge-offs for Bank of America in 1989. With that experience, Dave introduced selling charge-offs from financial institutions by hosting the industry’s first debt sale conference in 1994. Since then, Dave and his team have supervised sales of over 5,000 portfolios with face value of $150 billion in the US and Canada.

Dave has a Bachelor of Science Degree in Economics from the University of Illinois and has been in the financial industry for over 25 years. Considered a pioneer in the debt sales industry, he has been a featured speaker at industry conferences and quoted in numerous national media outlets.

Here is a glimpse of what Dave shared in the interview.

… but most said, “No, we will never sell charge-offs. That’s a crazy idea. Why would we do this? You’re going to sell to someone that we’re going to lose control of, that’s going to violate… going to threaten to break legs and we’re going to be brought into law suits.”

… because this was before electronic media. Everything is in hard files. When we were doing a sale back then we would set up a war room of all these files, these cardboard boxes of files that people would come in and go through.

… because all we are is a relationship business. We don’t make widgets. There’s nothing we’re buying and selling. It’s a relationship business…

Connect with National Loan Exchange, Inc. (“NLEX”) and Dave Ludwig:

http://www.nlex.com